Create Your First Paystub for FREE!

What is a Pay Stub?

A pay stub, also known as a paycheck stub or pay slip, is a crucial document that provides a detailed breakdown of an employee’s earnings, tax withholdings, and deductions. This document serves as a transparent record of the financial transactions associated with an employee's salary or wages.

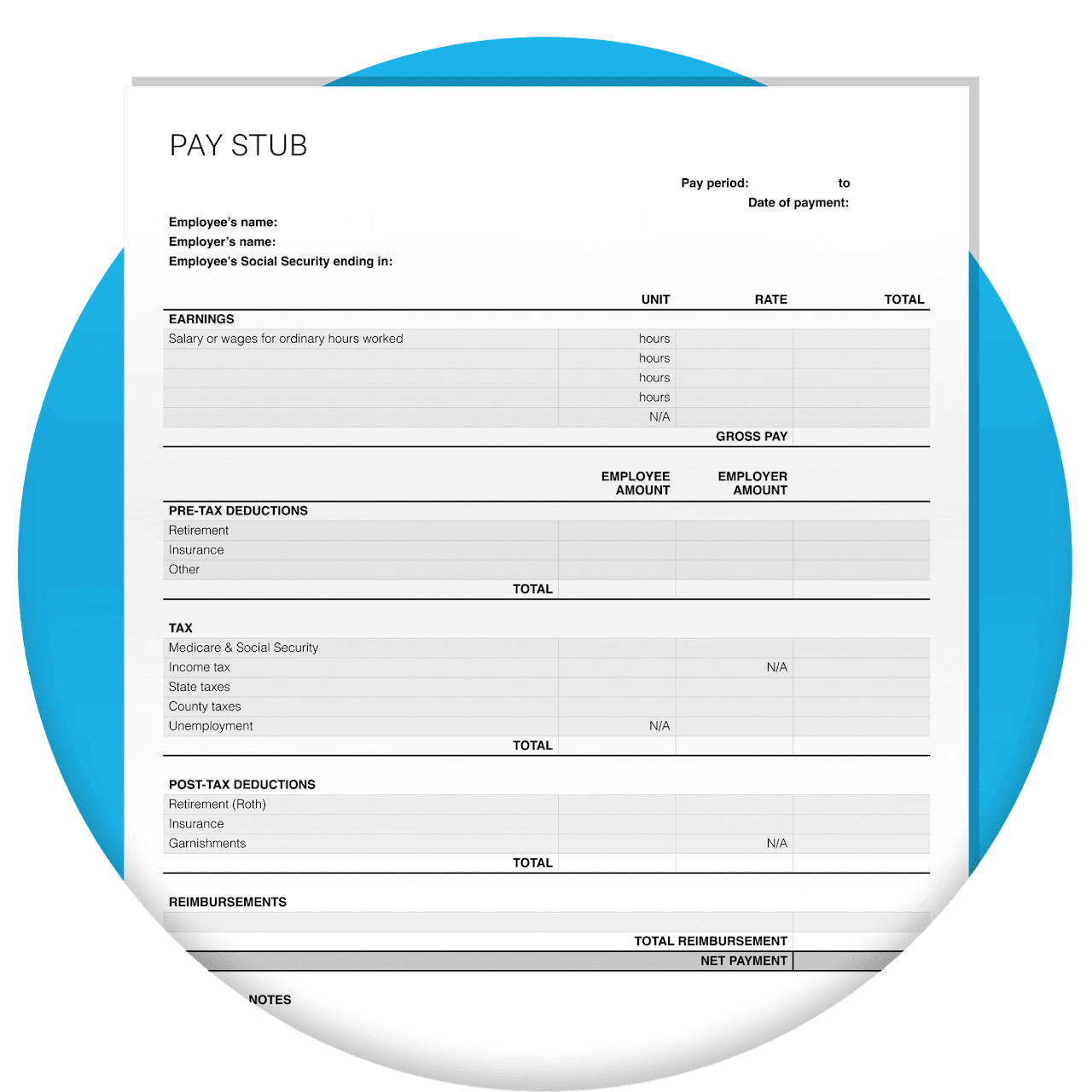

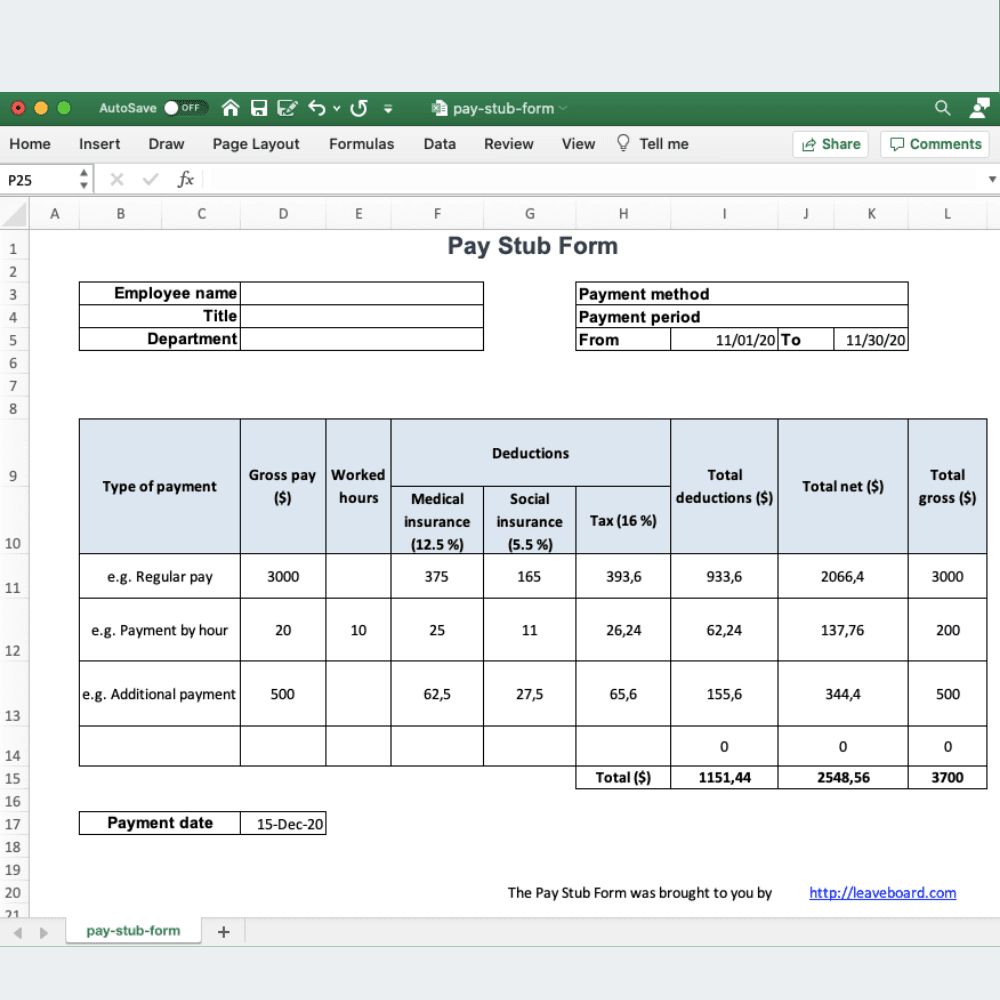

Key Components of a Pay Stub:1.Earnings: The pay stub details the employee’s pay rate and distinguishes between salaried and hourly employees. For hourly workers, the number of hours worked is clearly listed, while for salaried employees, the pay stub reflects the total earnings for a specific pay period.

2.Gross Pay vs. Net Pay:

- Gross Pay represents the total earnings before any deductions are made.

- Net Pay is the amount an employee takes home after all taxes, deductions, and other contributions have been subtracted from the gross pay.

3.Tax Withholdings: Pay stubs must include mandatory tax withholdings such as:

- Federal and State Income Taxes

- FICA Tax:The employee's share of Social Security and Medicare taxes.

- FUTA or SUTA:Federal or State Unemployment Tax Act contributions.

4.Deductions: Common deductions reflected in a pay stub include:

- Insurance Premiums:Health, dental, and life insurance.

- Retirement Plans:Contributions to pension plans or 401(k) accounts.

- Other Voluntary Deductions:Such as union dues or charitable contributions.

5.Additional Coverage and Contributions:

- If an employee has used paid time off (PTO) or is entitled to reimbursements for work-related expenses like travel, these will also be noted on the pay stub.

- Employer contributions to benefits or retirement plans, as well as employer-paid taxes, are also itemized.

Frequency of Pay Stub Issuance:

Pay stubs are generated and distributed according to the pay cycle established by the employer, whether weekly, bi-weekly, monthly, or otherwise. Each pay stub provides a clear snapshot of the employee’s financial status for that period, ensuring transparency and accuracy in salary management.

Who Needs a Pay Stub?

A pay stub is a vital document for anyone involved in a work arrangement, whether you’re an employer, employee, freelancer, or independent contractor. Here’s why:

Employers

For employers, pay stubs are crucial for tracking employee compensation and ensuring accuracy in payroll processing. They help verify that salaries are correctly calculated, taxes and benefits are appropriately handled, and payments are made on time. If discrepancies arise in an employee’s net pay, the pay stub serves as a reliable reference to identify and correct any errors.

Employees

Employees rely on pay stubs to keep track of their earnings, including hours worked and days paid. Additionally, pay stubs provide essential proof that taxes, insurance premiums, retirement contributions, and other benefits are properly deducted and accounted for.

Self-Employed Individuals

For self-employed individuals, managing payments and financial records can be complex and time-consuming. Consistently producing accurate pay stubs is crucial for maintaining clean and reliable financial records. Pay stubs help document past expenses, track pending payments, and provide clear records for tax and accounting purposes.

Contractors and Freelancers

Contractors and freelancers, like traditional employees, need pay stubs as proof of income. Since they work independently, creating pay stubs is essential for documenting earnings, handling taxes, and maintaining financial transparency.

What is Included in a Pay Stub?

A pay stub is an essential document that provides a detailed breakdown of an employee's earnings and deductions. Below is the key information typically included in a pay stub:

1.Employer Information: This section contains the employer's name, company name, contact information, address, and bank details.

2.Employee Information: It includes the employee's name, address, contact information, and bank details.

3.Pay Rate: The pay rate indicates how much the employee is paid per hour or per pay period and is used to calculate their earnings.

4.Gross Wages: Gross wages represent the total earnings before any deductions, such as taxes and benefits.

5.Net Wages: Net wages are the amount the employee takes home after all deductions, including taxes and benefits, are subtracted from their gross wages.

6.Federal Taxes Withheld: This section outlines the federal income taxes withheld based on the employee's tax bracket.

7.State Taxes Withheld: Similar to federal taxes, this section details state income taxes withheld, which vary by location.

8.Local Taxes Withheld: Local taxes, if applicable, are also deducted and are common in larger cities or metropolitan areas.

9.FICA Contributions: This includes Social Security and Medicare taxes. Social Security taxes are 12.4%, split evenly between the employer and employee, while Medicare taxes are 2.9%, also shared equally.

10.Insurance Deductions: This section covers health insurance premiums and possibly group-term life insurance offered by the employer.

11.Retirement Contributions:Contributions to retirement plans, such as 401(k) or Roth IRA, are detailed here, depending on the employer's offerings.

12.Wage Garnishments:If applicable, this section outlines any court-ordered deductions, such as alimony, child support, or loan repayments.

This information is crucial for employees to understand their earnings, deductions, and the amount they take home.

Why Do You Need Pay Stubs?

While there’s no federal law mandating employers to provide pay stubs, having them offers significant advantages whether you’re an employer or self-employed.

Here’s why pay stubs are essential:

1.Loan Applications:Lenders often require proof of income when approving loans. Pay stubs serve as a reliable source to verify your earnings.

2.Accident Compensation:In the event of an accident, pay stubs can help establish your regular income, making it easier to calculate lost wages during your recovery period.

3.Renting:Landlords and rental agencies typically request several months’ worth of pay stubs to confirm your ability to pay rent.

4.Resolving Payment Discrepancies:If there’s an error in your paycheck, comparing it with previous pay stubs can help identify and resolve any inconsistencies.

5.Tax Filing:Pay stubs provide crucial details on your tax withholdings, including federal and state taxes, FUTA, SUTA, and FICA, ensuring accurate tax filings.

6.Business Transparency:Maintaining organized payroll records and submitting tax documents on time reflects a business’s commitment to transparency and adherence to legal requirements.

Having pay stubs on hand is not just about meeting legal standards; it’s about protecting your financial interests and maintaining trust in business transactions.

Online Paystub Generator

Discover the Best Online Paystub Generator for Your Needs

Learn how our online paystub generator simplifies paycheck creation, offering flexibility and accuracy. Ideal for employees, freelancers, and small businesses.

What are the accepted payment methods to create a paystub?

The service accepts the payments that major Credit and Debit Cards as well as the ones like Visa, Mastercard, and American Express.

Do I have to pay any additional charges to make updates to my pay stubs?

No, it is not the case. Most platforms give unlimited or free updates/corrections to a pay stub that you have already purchased for a specific period (for example, 48 hours or longer). This way, you will not be charged extra for correcting simple data entry mistakes.

When can I access my pay stubs?

You can get your pay stubs right after you finish the payment. They are generally available for immediate download as a PDF and will probably be sent to your registered email address as well.

Free Paystub Generator

Create Your Free Paystub Instantly with Our Easy Generator

Generate professional paystubs for free in just minutes with our easy-to-use online generator. Perfect for tracking income and ensuring accuracy. Try it now!

Best Paystub Generator

Find the Best Paystub Generator for Your Business

Compare top paystub generators and choose the best one for your business needs. Get accurate, compliant paystubs with ease. Explore your options now!

Paystub Generator with Tax Calculations

Simplify Tax Calculations with Our Paystub Generator

Automatically calculate taxes and deductions with our advanced paystub generator. Perfect for accurate payroll management and financial planning. See how it works!

Easy Paystub Generator

Try Our Easy Paystub Generator for Quick Results

Generate paystubs in minutes with our simple and intuitive generator. Perfect for busy professionals and small businesses. See how easy it is!

Affordable Paystub Generator

Discover the Most Affordable Paystub Generator Options

Find out how you can generate accurate paystubs without breaking the bank. Explore our affordable paystub generator options today and save on payroll costs!

Best cheap paystub generator online

Discover the Best Cheap Paystub Generator Online

Explore our top-rated cheap paystub generator online. Create accurate paystubs in minutes at an affordable price. Get started today with our easy-to-use tool.

Best-rated cheap paystub generator

Best-Rated Cheap Paystub Generator for 2024

Discover the best-rated cheap paystub generator for 2024. Trusted by thousands of businesses for accuracy and affordability. Try it today!

Looking for the best pay stub generator?

Look no further than Stubcheck.com! Our platform offers a top-tier pay stub generator that stands out for its user-friendly interface, affordability, and reliable solutions. With Stubcheck.com, you can effortlessly manage your payroll, taxes, and payments, all in one convenient place!